Investing for beginners can feel thrilling and daunting at the same time. After all, you are risking your own money on your own financial decisions. There’s a lot a stake. As a beginner, how do you start investing? How do you avoid the most common pitfalls? Most importantly, how can you compete in the market against trained professionals and expert hedge fund managers, while still turning a profit? This is the total guide about investing for beginners. We will answer all your questions, and more.

Before we dive into investing for beginners, here’s the classic disclaimer. This is not legal or financial advice: you are responsible for your own investment decisions. As with everything in life, you should take everything with a grain of salt – including this guide – and use your judgement.

Now that the legal part is over, let’s outline this investing for beginners guide. We have divided into three core sections, plus some extra material you will find useful.

- Investing for Beginners in Less Than 1 Minute – if you are in a hurry, we tried to compress all the content of the guide in one brief paragraph.

- Investing for Beginners 101 – here you will get to know the basics of investing for beginners, the key concepts and terms. This section acts as a gateway to the rest of the guide, and it contains:

- The “How-to” Investing for Beginners – this section is about what investing for beginners is all about. Here we will see what to do and what are the best investment strategies for beginners, and give you the tools to understand them. We do that by covering the following topics

- Practical Guide for Beginner Investors – in this last core section we get technical, now that you now what do to we see how to do it in practice. We will see how to find investment and how to actually invest your money in them. In this section we cover:

- Conclusion – in this brief chapter we wrap up everything and give you some final insight to start your investing for beginners journey.

- Suggested Readings – if you read the entire guide, you are probably a good reader. So this is where you should continue reading

- Sources – the sources used in this guide.

Each chapter starts with a simple quote as a guiding question, this will help you understand better each and navigate this guide more efficiently. Enjoy!

Investing for Beginners in Less Than 1 Minute

If you want to grab the best of this guide without reading it all, here you have it. Yet, if you really want to invest you may want to read the whole guide.

You may be able to beat the market in the short term, but in the long run you can only do as good as the market – or worse. So, you should find a way to invest in the whole market with a single diversified financial product. This will also enable to maximize your profits by significantly reducing transaction costs (cost of buying and selling), as well as delaying taxes. A good approach is to invest in an ETF based on many stocks from all around the world, such as iShares MSCI ACWI UCITS ETF. You can buy this with your bank or through an online broker, and then all you have to do is hold.

Confused by this? That is not a problem, we just tried to compress the entire investing for beginners guide in just one paragraph. If you take the time to read it all, it will be all clear.

Investing for Beginners 101

In this first part of the investing for beginners guide, we will get comfortable with the key investment concepts. We will see how to think about money like an investor, what drives the return of an investment (the amount of money you can make by investing), and how time affects the value of your investment. We will conclude with a list of investment opportunities when investing for beginners, as well as some key term you need to know to navigate in the financial world.

The Concept of Capital

Start to think about money in a different way.

As a beginner investor, the first concept you need to understand is capital. In short, it is money put to good use. Most people think about money in an abstract way, but – truth to be told – money is just another tool that can generate value, much like a car, an oven, or a hammer.

Imagine you own a bakery shop: you buy an oven to bake your craft that you will sell. By buying the oven, you renounce at some money in exchange for the oven. How much money? That is the price of the oven. Virtually, you transformed your money into the oven. Now the oven can go on and produce, and you can make some profit out of its usage.

As long as you own the oven, you can get the money you get by selling your bakery goodness, but you can’t use the money you used to buy the oven. That money is the oven. At some point, you may decide to sell the oven and get your money back – recovering your capital.

Of course, the oven will be worth less by the time we want to resell it because of wear and tear, and only by the fact that it is not new anymore. Let’s forget about this for the sake of the example, and assume it will be worth exactly the same.

While you hold the oven, however, your money is invested in the oven, and you can’t do anything else with it. Capital is money put to use to produce something, for example buying an oven that you can use to produce baked products.

Cash Flows

The value of money changes with time. How do we make sense of that?

When you invest your capital, you will create some cash flows. A cash flow is a flow of cash, a stream of money coming at your (or going away from you).

In the bakery example, the cash flow is the amount of money you receive by selling your baked products. We say it is a cash flow because you don’t receive all your money at once. You sell product over time and receive money over time. Hence, money is flowing at you over time.

Of course, a cash flow has no direction by itself. It can be either an inflow (money coming in, such as in the case of the products you are selling), or an outflow (money going out). An example of cash outflow can be your subscription to Netflix, Amazon Prime, or whatever service you pay monthly or yearly.

Technically, a one-off payment is still a cash flow: it is recurring for just one recurrence. So, never think about money by itself, but about money coming in or going out of your bank account.

Financially, we tend to use a timeline to represent cash flows. We simply draw a line, dividing it by the number of periods that we need (generally years, sometimes months, quarters, or even weeks). Then, on each period we write the amount that is received or paid for that period.

This allows to easily visualize how money is coming and going, and it is important to understand. This also unlocks the next investing for beginners concept: the time value of money.

The Time Value of Money

Money in the future is worth less than money today. How do we compare the two?

The time value of money is a crucial concept in finance. In fact, we can say that finance entirely revolve around this concept. Many beginners’ guides just skip this concept, but this is not the case today. In fact, if you want to know more about investing for beginners, you must know the concept of time value of money.

As the name suggests, money is not a static value. Its value depends on time. That is no surprise, consider the price of houses in the USA: the median home value was $7400 in 1950, and $221,800 in 2010[1]. Clearly, the price and quality of houses went up. However, the price of everything went up, not just houses, so we can say the dollar itself lost some purchasing power.

Before you jump to conclusions like “I know, that’s inflation” – it’s much more than just that.

The idea is this: if you have some money now, you can invest it and turn it into more money in the future. If you have a deposit account yielding 1% interest per year and you put $100 in it, you will end up $101 at the end of the year. Hence, $101 at the end of the year are the same thing as $100 in cash now. This is because you could take the money now, invest it, andget the $101 in the future.

If we continue with this example, at the end of year 1 we have $101 in the bank, and here 1% is $1.01. This means, at the end of year 2 we will have $102.01. We can see that $102.01 in 2 years is equivalent to $101 in one year, or $100 today. As you see, our amount of money grows faster and faster (first only by $1, then by $1.01) because of compound interest: we earn interest on the interest we already earned in the previous year or period.

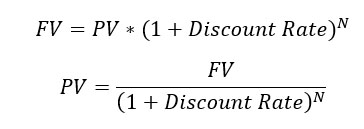

We can then draft the formula to calculate how much money today will be worth in the future. This means calculating the future value (or simply FV) of your money today. In this formula, we simply need to consider the compound rate, which is the interest rate for 1 period expressed in fraction (e.g., 0.1 indicates 10%, 0.5 indicates 50% and so on), elevated to the number of periods. Then, we multiply this rate by the amount of money we have now. Note: we call the compound rate discount rate because it tells how much we should reduce (discount) the value in the future.

Thinking in this way, we can also rearrange the formula to calculate the present value (or PV) of an amount of money that we will receive in the future.

Let that sink: this is crucial. Present value is the key to finance, and also to investing for beginners. It allows us to compare cash flows (amounts of money) that we receive in the future, at different points in time.

Of course, the key variable that influences this value is the interest rate, or rate or return. This is not just set arbitrarily, nor set simply to the rate the bank is offering to you. Continue reading, because we will see how this value is influenced by risk, and how to identify the correct interest rate in every circumstance.

Note that you don’t need to bang your head on these formulas, at least for now. You can simply be sure you understand the overall concept, that would be enough to proficiently learn investing for beginners. With time, you may want to come back to this and dive deeper, also considering our sources and reading suggestions at the end of the guide.

Perpetuity and the Time Value of Money

How much is it worth a monthly payment we receive forever?

In the previous example, we put $100 in the bank we turned it into $101 in one year, or $102.01 in two years. Yet, we can also adopt another strategy. We can put $100 in the bank now, and get $101 in one year. At that point, instead of leaving it all in the bank to earn further interest, we ca withdraw $1, leaving $100 in the bank. This will turn into $101 in 2 years, and we have another $1 to withdraw. We can continue this process indefinitely, granting ourselves $1 a year potentially forever.

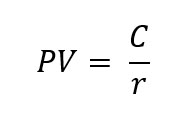

You already saw that, to create that, we simply need to have $100 now (at least, at the 1% interest rate). So, in our example 1$ a year forever is equivalent to $100 in cash now. We can formalize this relationship with the following formula.

Here, we are simply dividing our desired payment for a period for the interest rate we earn over that period. It is like asking: what is the amount that will yield this interest payment, at this rate? Or, even simpler, what is the amount of which the 1% (in this case) is my desired interest payment.

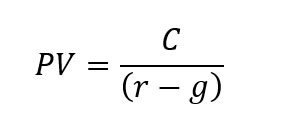

Since we know that money loses value over time, we can throw into the mix a growth rate. This is how much we want our monthly payment to grow year after year, to protect against losing purchasing power. We can set any growth rate that we want, as long as it is less than the interest rate. This effectively means, how much of our interest we should withdraw, and how much we should leave in the bank to grow.

If the interest rate is 2% and we want a 1% growth year on year, then it means we will leave 1% in the bank and withdraw only the remaining 1%.

All of this to say, an amount of money in cash today can recreate any cash flow, even one that gives you money in perpetuity. This is crucial, because it means we can translate any cash flow, no matter how complex, into a single number: the amount it is worth today. Hence, we can compare all cash flows with one another using their present value.

Risk-Return for Beginners

Risk plays a crucial role in investing. How does it influence our return?

Investing for beginners is all about understanding the risk-return tradeoff. Before we can do so, we should start by defining risk. Risk is simply uncertainty of outcome, positive or negative. It is how much our returns (that is, the money we earn by investing) can vary year on year. It is the volatility.

We cannot predict with certainty the volatility, but we can have a projection by calculating the standard deviation[2] of previous historical returns. This is a statistical formula, and it isn’t even so complex, but that’s beyond the point for today.

Intuitively, the more your returns are volatile, the more your returns are at risk. Since they are volatile, you may make way more money, but you may even lose more money than with a less volatile investment. Over time, the high ups will cancel out with the worse downs, but the average will not be the same as the low volatility investment. It will generally be higher.

This is because since you are putting your money more at risk, you (as any other investor and thus “the market”) demand a premium, extra money for taking the risk. We say premium because there is a baseline interest that you earn with no risk, that is the risk-free rate. You earn this by investing in US Treasury bond, that allegedly bear no risk. Any other investment has some level of risk, and as such it offers a risk premium, that is an extra return above the risk-free rate. In case you are wondering, the risk-free rate is particularly low (less than 1%).

Where does risk come from? It may be that our customers will not pay, that an earthquake will disrupt our plant, that a global pandemic will destroy our supply chain, or simply that it will be a bad year for our market. There are countless sources of risk, but financially we consider only two: idiosyncratic risk and systematic risk. This difference is crucial, because each type influences our investment differently.

Idiosyncratic Risk vs Systematic Risk

How does more risk justify higher returns for our investment?

We know that there are two types of risks:

- Idiosyncratic risk, or diversifiable risk, is the risk that is specific to a company, and that investors can diversify. This means other companies will not have the same risk, and thus investors can invest in other company to make this risk null. More on this later

- Systematic risk, or undiversifiable risk, or market risk, is the risk that cannot be diversified away. No matter how hard an investor may look around, all other companies or investment opportunities will all bear this risk, so the investor is not better off by looking at other alternatives.

Each company is exposed to some idiosyncratic risk and some systematic risk. Imagine for example airlines, that are significantly influenced by oil prices. When oil prices go up, profits for airlines are squeezed, so they perform poorly. However, an investor may invest in airlines while investing in oil producing companies at the same time. If the oil prices go up, the airlines will do poorly but oil producing companies will do great, canceling each other out. On the other hand, when oil prices will be down airline will do great, while oil producing companies will do poorly, again cancelling each other out.

Because of this, idiosyncratic risk does not demand a premium. This risk can simply be nulled without sacrificing returns by adding other investments in parallel. Instead, that is not the case with systematic risk. So, each investment offers a rate of return or interest rate based on the systematic risk it contains – not all risk and thus volatility.

At this point, we have the foundational concepts of investing for beginners. We can turn to some lexicon and opportunities that are in the market that you will encounter frequently.

Risk-Return and Correlation

How can I diversify a portfolio to reduce risk without sacrificing returns?

We know from the previous two sections that we need to reduce our idiosyncratic risk as much as possible, and to do that we need to add investments to our portfolio that cancel each other’s idiosyncratic risk out. How do we go about it? We need to consider correlation.

Correlation is simply how much two investments go in the same direction. If investment A goes 1% up and investment B also goes 1% up at the same time, then there are 100% correlated. If instead investment B goes down 1%, then they are 100% negatively correlated (they do the opposite). If they have no relationship, then correlation is zero. Of course, this must be assessed over multiple periods and not just on a single measurement. In any case, there will be some degree of correlation ranging from -1 to 1.

Now imagine two stocks with a correlation of 1, with two different returns: stock B has higher return and higher volatility. If you have a portfolio only with two stocks (A and B), you can decide how to combine them. You can buy a lot of A and only a little of B, vice versa, or anything in-between. All the potential portfolios are represented by the line in the following chart. This lines goes from a portfolio of only A (no B) that has lower risk and lower return, to a portfolio of only B (no A), with higher risks and thus returns.

In reality, however, investments will rarely have a 100% correlation: it will be lower. The lower the correlation, the more the curve will bend toward the top left. This means you can find a combination of the two stocks that reduce risks while not reducing returns, or that increases returns without increasing risk. You should look at the point on the line that has no other point in the chart to its top left.

How do you plot this line? This is a topic beyond today’s investing for beginners. However, know that for the purpose of investing you don’t strictly need to know the calculations behind it. Rather, you should grasp the concept of how correlation (or the lack thereof) can help you diversify and give you better return.

Of course, in these examples we did everything with two stocks. In reality, you can combine as many stocks as you want, and potentially the entire market, to find an even better combination. Stay tuned, because you will learn the best way to do this at the end of this investing for beginners crash course.

Must-Know Terms when Investing for Beginners

Financial markets have their own jargon. What are the terms we must absolutely know?

So far, we did not care much about lexicon. That’s fine, in fact you can harness a great financial knowledge without using the “proper” terms. However, it is highly recommended, because with these terms you will be able to read financial reports, compare investment opportunities, and just understand what other investors are talking about.

There are many financial terms, but you simply couldn’t go a day without knowing the following ones.

- Asset – something that an entity, like a company, owns. It is a resource, and it can be tangible (e.g., a factory, equipment) or intangible (e.g., patents, licenses, money, financial instruments). From an accounting point of view, it is everything the company holds to get economic benefit from.

- Liability – it is “the opposite of an asset”, a financial obligation a company has to a third-party. The most typical are loans (you owe a set amount of money), but also accounts payable (you received goods from your suppliers, but you still have to pay) and warranty to customers.

- Principal – in a loan, that is the amount of money you give to the borrowers, and the borrower will agree to pay an interest on it. In financial market, unlike mortgages, loans are not amortizing. This means the borrower keeps the principal until the end of the loan, and repay it back all at once at the end.

- Maturity – time horizon of an investment. In the case of the loan mentioned above, it is the time at which the borrower will return the principal.

- Equity – the collection of “tokens of ownership” for a company. As we will see, a company can have many owners, and sells “a piece” of ownership in the company in the form of tokens, such as stocks. We refer to these tokens, these pieces of paper (now digital) that entitle to some ownership in the company as equity.

- Seniority – If you invest in a company and things go south so that the company has not enough money to pay out all investors, seniority determines how get paid first. Seniority refers to an investment vehicle, such as stock or a loan, and not to the investor herself. The company will have to satisfy all the claims from investors holding the most senior investment vehicle, before moving on to satisfy the next-senior in the line.

- Solvency – the ability for a company to pay its debts (such as its monthly or yearly interests)

- Liquidity – how easily and how fast an investment can be converted into cash. Referred to a company, it is the availability of cash at hand the company has. It is different from solvency, because not all assets can be converted easily into cash (cash is already cash, but selling a factory may take time and you are not sure how much money you would make, so that asset is illiquid).

- Default – situation in which a company is unable to pay its debt.

Obviously finance is full of many other terms that are useful to properly assess investment opportunities, such as balance sheets, comprehensive statements of income, and many others. This is still a guide on investing for beginners, so we focus on the things you absolutely need to know.

Why all that fuss on companies? Because companies drive the economy. True, government play a key role as well, but investing in governments is relatively simple to understand, as the tools to do so are more limited.

Investment Vehicles

What are the tools available to invest?

As you recall from the beginning, investing is putting your money to good use. In other words, you give your money to some entity that will make your money grow or give you a recurring payment. What are the options we have available?

Any investment you can make is an investment vehicle. If you buy it in the financial markets, we say it is a security (short for financial security), or simply financial instrument. You can have other alternatives outside of financial markets, such as starting your own company or purchasing your own aluminum mine. Those are somewhat beyond the scope of this investing for beginners guide.

The most common financial securities are:

- Treasury bonds – offered by the US Treasury, you give your money to the Treasury, and they will pay you a return. They are considered risk-free, depending on the maturity. Payment is granted, as it is a form of debt.

- Sovereign bonds – much like US Treasury bonds, but offered by other countries different than the US.

- Corporate bonds – bonds offered by any company. It is a form of debt, so payment is granted unless the company defaults, in which you may get less money.

- Stock (or shares) – token of ownership in a company, you are entitled to the residual profit after the company has paid interest on its debt. You bear more risk, and payment is not granted. The company can either pay you in cash (with a dividend) or retain the cash, in the latter case your stock appreciates in value, and you can realize a cash profit by reselling the stock at higher price.

- Investment Funds – you give your money to a money manager, which invest it into other financial instruments for you. They typically charge a base fee, plus a performance fee based on returns. It is an active investment, because the money manager is a person who buys and sell other securities for you.

- Hedge Funds – a type of investment fund catering to large investors (companies, institutions), helping them diversify. Normally off the table for normal people. For example, McDonald’s was exposed to the fluctuation of the price of soy, main fodder for chicken used in Chicken McNuggets. If price of soy went up, McDonald’s profits were squeezed. To avoid this, the company Bridgewater Associates arranged some financial investments so that if price of soy went up, they will gain from those investments, offsetting the losses in the sale of McNuggets[3]. Effectively, the company hedged against soy prices.

- Venture Capital – another special type of investment fund that specializes in funding companies in incredibly early stages, start-ups. The idea is: invest in many small companies considering that most with fail, but the very few that will succeed will make you a lot of money. Since companies are early in their life and most didn’t even turn a profit, venture capital investments are highly illiquid[4].

- Index – A group of financial securities that aim to represent some specific part of the economy. For example, the S&P 500 aims to represent the largest company in the USA. It is not an investment vehicle by itself, it serves as a benchmark of performance to other instruments.

- Exchange Traded Fund (ETFs) – they are passive investment vehicle, not actively doing any buying and selling. They simply mirror (or try to mirror) an index by buying the securities that compose it. You can buy an ETF in the market, and it is like investing in an index.

There are many other investment vehicles, namely IPOs and SPACs. However, this is an investing for beginners guide, and I doubt any hedge fund manager will come here to read how to manage an IPO before going into a meeting with investors. Instead, it is time to do a deep dive on the investment vehicles a beginner can use. Some we already mentioned, others will be new.

Investment Vehicles for Beginners

What are the investment opportunities for beginners?

Investing for beginners should be done with the right tools. Here, we focus on the investment vehicles that are available to beginners. It doesn’t mean all of these vehicles are a good choice for beginners, it just means that if you want, they are at your disposal relatively easily (through your bank, through an online broker and so on).

- Treasury and Sovereign bonds

- Corporate bonds

- Stocks

- ETFs

- Foreign Exchange (FOREX) – you borrow money in a currency (say dollars) and you use the proceeds to buy another currency (say, Euro). You are hoping for the currency you bought will appreciate in value compared to the other currency, so that a later point you can use your new currency (Euro) to buy back dollars at a lower price to return to the lender, and pocket the difference.

- Options – this is a derivative instrument, as it is based on other financial instruments. You buy the opportunity to buy (or sell) another financial instrument at a predefined price at a specific point in the future. For example, with an option you can literally buy the possibility to purchase stocks of Company A at current price, but in a month from now. If the company stock increases in price, you will be allowed to buy at below-market rates, and you can quickly resell it and make a profit. If you do not exercise the option (buy the security when allowed), the money you used to buy the right to buy (that is, the option) are gone for goods. Options are cheap, but they can sound like a bet.

- Future – an option that is traded on an exchange, typically offers the opportunity to buy or sell a commodity at current price one month from now. This is the way you can invest in commodities, such as oil, gold, wheat, aluminum and so on.

- Cryptocurrencies – Things like Bitcoin or Ethereum, they would deserve a special article and they are highly speculative, not recommended for investors.

Now that you know what your options (no pun intended) are, we can focus on the active part of this investment for beginners guide. We will see how to pick an investment and what are the reasons for doing so.

The “How-to” Investing for Beginners

In this second section, we build on the knowledge to really start talking about investing for beginners. The goal of this section is to provide you with a clear, actionable investment strategy that you can follow as a beginner. Not only that, we need to equip you with all the knowledge you need to understand why that would be a good strategy for you. Furthermore, you will gain some key insight to critically discuss investments other people propose to you.

This is a “put your money where your mouth is”, because I am personally invested in this type of investment strategy as well at the time of writing this article (June 2021).

Net Present Value

How to define if an investment is “good”?

We know we have many potential ways to invest in many different things. However, we do not have infinite money, so we need to be picky and decide what is the best investment for us. This is the same concept that applies to investor and to business owners as well. How do you decide if an investment is worth pursuing?

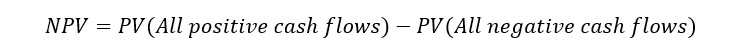

Introducing the Net Present Value, abbreviated in NPV. If you read the Time Value of Money early in this guide, you know about present value. Present Value is simply traducing the value of an amount of money received at some point in the future in the equivalent value of “money today”. This is because money today is worth more than money in the future (if this is unclear, you may want to go back and read that section once more).

NPV is simply the sum of all positive cash flows (money we receive) minus the sum of negative cash flows (money we pay) for a transaction, in terms of present value. The idea of present value is essential because we need to compare cash flows coming at different points in time.

In fact, if you invest your money in something, you pay something now for the investment to receive some cash flows at some point in the future.

Once you calculate the net present value of all the investments that are available to you, you should invest in the one with the highest NPV. Then, use the leftover money to go on the second and so on, until you invested in all the money you wanted to invest. Never undertake a negative NPV investment – that is basically losing money.

At this point you may ask: how do I know the cash flows of an investment? After all, it is unsure how much money a stock or corporate bond will yield to you. If you don’t know that, you shouldn’t be able to calculate NPV, right? That is true, however the market – that is, all the investors collectively – can help you with that. How? Read on.

Financial Transactions have a NPV of Zero

Are there any fools in the market?

If you buy something, it means someone is selling it to you. Now, imagine you have a $1 bill. You would exchange it to me if I gave you another $1 bill, or more than that. On the other hand, I would accept the exchange only if I gave you another $1 bill, or less. Less than $1 and you would not be satisfied, more than $1 and I would not be satisfied. So, the only amount we can settle on is $1. Here, nobody is gaining or losing from the transaction – the transaction has an NPV of zero: it is indifferent to do it or not, for the both of us.

The same example can apply to anything. Imagine that now you have $1 and I have a bottle of soda, or that you have $500,000 and I have a house, or anything else. Neither the buyer nor the seller would accept a “bad deal”.

In financial markets, where all prices are quoted minute-by-minute, the risk of bad information is even lower. If a stock is worth $100, it is because investors collectively expect it to generate cash flows for a present value of $100. So, you will pay $100 now and receive cash flows later for the present value of $100, making it a zero-NPV investment.

So, in short, all financial transactions have an NPV of zero. This means there are no fools in the market, and that there are no bargains. True, sometime the market as expectations that turn out to be unrealizable, but over the long run the market is right. How is this possible? How can you make money if NPV is always zero?

This is where we turn next as part of our investing for beginners guide.

The Tangent Portfolio

What is the best investment ever?

In short, according to the Modigliani-Miller theorem the best investment is the tangent portfolio[5]. Since financial transactions have an NPV of zero, it means they are all fairly priced: the price directly represents their return, also taking into account the uncertainty of that return (and thus risk).

Always according to Modigliani and Miller, since investors are not fools, they will accept always the same payment for the same level of risk. For example, if they demand a 10% interest for any investment of volatility of 6%, then any investment of volatility will have to offer 10% interest. If it offers less, nobody will want to invest, and they will have to offer a higher return to lure investors. If they offer more, they will have more investors than they could satisfy and they would start to offer less until an equilibrium is reached at 10%.

If we combine all investment opportunities in the world to diversify for idiosyncratic risk, we get many potential portfolios that can be plotted on a line: the Efficient Frontier. No individual investment exists to the top-left of this frontier. Of the portfolios on this line, there is one that is the best portfolio of all: the tangent portfolio.

At the very left of the diagram you have the risk-free rate, that has no volatility. If you draw the tangent line starting from this risk-free rate and touching the security market line, you get the Capital Allocation Line. This is the line where the most efficient portfolios reside. The best of the best.

This line simply represents combinations of risk-free investment with the tangent portfolio (the portfolio at the intersection point). If you want less risk, buy more of the risk-free investment, and use only part of your money for the tangent portfolio. You will get the best return at your desired level of risk. On the other hand, if you want more return you can borrow at risk free rate and buy more tangent portfolio than you can afford, increasing both returns and risk, but always getting the best return for the level of risk you are willing to accept.

The good news is that the tangent portfolio, also known as the efficient portfolio, is the market portfolio. That is, if you own a little bit of each possible investment in the world, you are holding the best portfolio possible. Of course, investment must be weighted: if Microsoft is 0.004% of all value of all investment opportunities in the world, then your portfolio needs to be made of Microsoft’s stock for 0.004% of its value.

Picking a Market Proxy

What is “the market”, anyway?

Okay, so now you know if you buy all stocks and other investment opportunities in the right proportion you will be best off. But how do you exactly do that? In practice, it is impossible to do so. Instead, investors turn to market proxies, representations of the entire market that look very much like it, even if they are not the market.

The two most commonly used as the S&P500 Index and the MSCI All Countries World Index. There are other alternatives, sure, but these are good benchmark because they highly correlate to the USA economy and the world’s economy respectively, so that investors consider them like market portfolios with a margin of error.

Historically, MSCI ACWI tend to have returns and risks slightly lower than S&P500.

Pick the best investment for beginners

Can you beat the market?

This is the question most investors ask to themselves: can you beat the market? Even when investing for beginners, we hear this question over and over. People feel like they know the answer, and more often than not they tell that yes, they can beat the market.

From the multibillion-dollar hedge fund manager to the beginner who started just last Sunday, everyone seems to have figured out some trick to be better than the market. At a first glance, it makes perfect sense. Think about the people who bought Bitcoin between 2016 and 2017, or again in 2020, or people who invested in things like Tesla, Microsoft, Apple, and so on. So, there must be a way to beat the market, right? Wrong! Sorry to disappoint you here.

You can’t beat the market in the long term. This is true no matter your experience level, whether you have just read this investing for beginners guide or whether you have two MBA for Ivy League universities. Nobody can consistently beat the market in the long run. Put it simply, this is because if you beat the market there must be someone who is consistently being beaten. That is, if all your transactions have a positive NPV, the other side must have a negative NPV and be unaware of that. Even if individual investors may have unreasonable expectations, collectively the entire market does not accept such scenario.

Again, let that sink. You can’t beat the market. This assertion is based on the Capital Asset Pricing Model, the most widely accepted method to evaluate the correct price for a financial security[6]. Long story short, the price is influenced by how much a security reflects the market: the more it is similar to the market in terms of risk, the more its returns will be similar to the ones of the market.

However, there are portfolios that seem to consistently beat the market. Why? Don’t be fooled so easily, and just read on to find out the truth.

Unpriced Risk

Can you beat the market, at last in some cases?

A portfolio of the smallest 20% companies in the S&P500 outperformed the S&P500 as a whole, grossing an average yearly return of 13.1% against 9.5%[7]. If S&P500 represents the market, then small-cap stocks are beating the market. They are better than the market, and they must show you can beat the market somehow.

Similarly, stocks of companies that have just engaged in corporate finance transactions such as mergers, acquisitions or spin-off also seem to deliver similar superior performance. This looks like a good sign that there are multiple ways to beat the market. But is that the case?

At a first glance, it seems that you can beat the market with the right portfolio. That is, you can gross higher returns without increasing your risk. What we are missing out of the picture is that CAPM is just a model for pricing, and it can be a good approximation, but it does not reflect the reality for every single little, tiny detail. In short, CAPM accounts for risk, but not all the risk. Evidence suggests that small-cap stocks yield higher returns because they have an additional level of risk, that is not priced in CAPM but it is reflected in their price (which is lower, leading to higher returns).

So, while you might beat the market on paper, you are actually just taking on more risk. Hence, the best way to increase your returns, no matter what is your risk preference, would be to buy more of the market portfolio – eventually with debt, if the market return is not enough for you.

The Quick Buck

Can you beat the market in the short term?

At this point of our investment for beginners guide, we have to say it. Yes, you can beat the market in the short term. In fact, at least some of the beginner investors out there are looking specifically for that. They would be fine without beating the market over the long run, but they want to do it just a few times at the beginning to make a quick buck.

Milton Friedman, Nobel prize in economics, used to say: “there is no such thing as a free lunch” (this is not the reason why he was awarded the prize)[8].

True, you can beat the market in the short term, but nobody knows how to do it until they do it by chance. In a sense, beating the market in the short term is a lot like gambling. You take on incredible amounts of risk and hope for an incredible payoff or virtually lose everything. It is exactly like going into a casino. You can have a good hand and win good a few times, but if you keep playing is the casino that will make the profits (at your expenses).

So, even if it is possible to beat the market in the short term, it is just incredible risk. Even Michael J. Burry, portrayed in The Big Short as the hedge fund manager who predicted the financial crisis of 2008, had less-than average performances after the crisis with his fund, suggesting that his incredible gains during the crisis were a one-time thing[9].

Transaction Costs

How much does it cost to invest?

Whenever you invest – that is, whenever you buy or sell financial securities – you incur in transaction costs. These are costs that your bank, your broker, the stock exchange, or any other financial intermediary will pocket to offer you the possibility to trade the securities. On top of this, actively managed investment funds also carry some fixed fees to pay the managers to decide which stocks to pick.

The most common transaction costs are spread: if a stock is worth $100, you may be able to buy at $100, but when you want to sell it, you may get only $99.98. This is because brokers keep a small gap between buying and selling price, the spread, to pay for their service.

Transaction costs relate to transactions. So, the more you transact – the more you actively buying and sell securities – the more you will pay. To minimize the transaction costs, you need to do as little transactions as possible.

Investing for Beginners and Taxes

How does it work with taxes?

No investing for beginners guide would be complete without mentioning taxes. You will have to pay taxes on your profits, and how and when depends on your jurisdiction. However, the most common approach that countries tend to adopt is to tax the profits when they are realized, and at a fixed capital-gain rate.

Profits are realized when you sell a stock. So, if you bought a stock at $100 and now it is $300 your profit is $200 ($300 – $100). However, you have not realized the profit just yet because you have not converted it to cash. When you do, then you will have to pay taxes on it. This also means that if you actively buy and sell, you will pay more taxes than holding and selling indefinitely (or not selling and using other strategies to reduce your taxable income, that are beyond investing for beginners).

In addition, most jurisdictions offer some tax deduction on losses on market investments.

The Ultimate Investing for Beginners Strategy

What investment should I make, as a beginner?

All this investing for beginners guide is coming together now. At this point, we have covered enough ground to provide you with a good option for investing, and you should be able to understand the reasons behind it. As always, never do something you do not understand – the goal of this guide was to make you understand that.

Considering that:

- You can’t beat the market over the long term

- Transaction costs and taxes means actively trading is more costly and can eat your profits

- Active funds managed by professional may earn a little more than indexes, but these extra gains are offset by the fees they demand

The recommendation is to invest in an ETF that mirror the market, combining it with an ETF of risk-free assets in a combination that reflects your risk appetite. Great index to mirror for the market are the S&P500 and the MSCI ACWI.

Good. How do we actually execute this strategy? This is the topic of the following and final section of this investing for beginners guide.

Practical Guide for Beginner Investors

In this final section of this investing for beginners guide, we turn to the practical “how-to”. We see exactly how you can invest in various financial instruments, and how to execute The Ultimate Investing for Beginners strategy we just mentioned.

Before we dive in, just an important note. Financial tools available to individual investors greatly depend on national laws and jurisdictions. If that was not complex enough, those laws change over time. So, it is just unfeasible and beyond the scope of this investing for beginners guide to have a comprehensive and always up to date snapshot of what is available everywhere. Rather, we want to equip you with what you need to get started.

This part of the guide is based on first-hand experience in Europe, as well as research for other western markets (North America, Australia) and India. Things may be different in other places.

You Need a Broker

How do you buy financial securities?

Even large hedge funds need a broker, and so do you as an individual investor. Simply put, a broker is an entity that has access to the stock exchange and can buy and sell financial securities on your request. Traditionally, this was actually a person you could call, but now everything is automated and done through digital platforms.

All this is based on the premise that you can’t walk in in the stock exchange and buy securities. You need to have an authorized broker that does that for you. So, this broker is a company. It may be a bank, or a company specialized in broking. No matter what, you want your broker to be legally authorized to trade securities – otherwise it is going to be some sort of scam.

To check for the list of brokers that are authorized, you need to find the regulating body of your country of interest. In the US, that is the Security and Exchange Commission (SEC). In Italy, it is called CONSOB. Those regulators will have a list of the companies that are authorized to trade securities in each country.

You have mainly two options to access a broker:

- Through your bank where you already have your current account. The bank may also be able to trade securities for you or have a partnership with a broker.

- Online brokers, such as Robinhood in the US or DEGIRO in the European Union.

We now turn to explore both solutions so that you can make better investing for beginners decisions.

Investing with Your Bank

How do you buy financial security with your bank account?

I personally use both approaches, but this is the one I use the most. Most banks offer the possibility to trade financial securities if you have a special “trading” account. Depending on the bank, they may charge a fee for this type of account, or they may let you have it without costs.

Once you have the trading account, you can access a platform in the bank’s website where you can search for specific securities and buy them, see your existing holdings and sell them, and so on. Short selling (that is, borrowing a financial security with the hope of returning it later when the price has dropped, so that you can pocket the difference and bet in the price drop) is generally restricted or completely unavailable in those platforms.

Furthermore, advanced investment tools such as options and complex derivatives are generally unavailable in these platforms. Since this guide is about investing for beginners, I think that is still reasonable and you should not feel limited by the lack of advanced instruments. Those are just for speculation or hedging.

The bank tends to pocket a commission for each transaction. It can either be fixed in amount, or as a percentage (<1%). Possibly, it is a percentage capped to a given fixed amount. In Italy, I have seen banks operating at a 0.25% commission capped at 35€ and other charging a flat fee of 19€, just to give you an idea of the range. Clearly, these commissions are reasonable if you trade in the thousands, but prohibitive (at least in the flat-fee case) if you trade one share at a time.

One big benefit of trading with a bank when you buy whole shares (not fractioned) is that you own the share, there is your name on the share. That is, if the bank were to go bankrupt, you still own the shares and you can transfer it to another bank. Arguably this is a great advantage.

Investing with Online Brokers

How do you buy financial securities, outside of your bank account?

With online brokers, you can turn yourself into the Wolf of Wall Street from the comfort of your sofa. This doesn’t mean it is a good idea. Online brokers are websites where you register and that offer you all sort of financial instruments you could possibly dream of.

Since they are not a bank account, they are not associated with your checking account and as such you need to register and make a wire transfer to the website, literally moving some of your money from the bank to this financial broker. Then, you can use the money you have here to purchase investments.

Most brokers have quizzes to test your knowledge before enabling advanced financial instruments to you, as this is mandated by the law in some jurisdictions. In addition, they offer derivative instruments such as fractioned stocks. Imagine a share of Apple is worth $1000. You can have a 10% fractioned share and buy 10% of a share at $100, so that you can invest the exact amount that you want in any given share. While this sounds great, your name is not on the share. The broker has its name on the share, so they own the share, and they then manage the split between customers internally. This is true for most online brokers even if you buy more than one entire share.

Some brokers claim they have no commission, and particularly eToro has been running a strong advertisement campaign about it. However, you should be aware there are many places where brokers can charge commissions.

- Commissions on deposit or withdrawal of money

- Commission when converting currency

- Spread between buy and sell prices

- Percentage commission on each transaction

- Monthly or yearly commission for keeping the account open

While the latter is so uncommon that you can imagine it does not exist, eToro is actually waiving only the fourth. You will still be paying a commission when depositing and withdrawing, which can be quite high (2% of total amount). So, never be lured by flashy advertisement and always check the details written in small text.

If you are looking for some brokers, I would suggest Robinhood, DEGIRO, and eToro, based on your jurisdiction.

Stock Exchanges, Tickers, ISINs

How do I tell my broker which financial security I want to buy?

Your first step is to register with a broker, either with your bank, with another bank, or with an online broker. Once you do that, you will have access to financial markets and particularly to stock exchanges.

Stock exchanges are like supermarkets for financial instruments. There are many supermarkets, and they all sell the same products, at about the same price. Stock exchanges are no different: most financial securities can be bought and sold on multiple stock exchanges, at equivalent price (if the price were not similar enough, there would be opportunity for speculation).

Depending on the broker you use, you may be able to search for financial securities on a specific stock exchange (such as the New York Stock Exchange NYSE, the NASDAQ and so on), or search a security and see all the exchanges where it is listed (that is, where you can buy and sell it). Online brokers often offer derivative products, and since your name will not appear on the share you cannot search for specific stock exchanges. In fact, most of those transactions happen only within the online broker and are not reported in the stock exchange.

So now you know where to look, but what do you look for? You need a way to identify the financial security you want to buy and sell. Most brokers offer you a text search, but that is not the only way. In fact, each financial instrument has an unique identifier.

Stocks, shares in companies, have a ticker, a short text name. For example, Apple ticker is AAPL. This ticker must be unique within the stock exchange where the company is listed. So, the true unique identifier for Apple is NASDAQ:AAPL (since it trades on the NASDAQ). If you search NASDAQ:AAPL you will find only one thing: shares of Apple.

Other investments that are not stock do not have a ticker. Instead, they have an International Standard Investment Number (ISIN). This is a code made up of two digits to identify the country where the investment is legally registered (it doesn’t have to be your country) and a unique number.

Just note that derivative products generally do not have ISIN codes. If what you want are options or fractioned shares, you just need to search for them. However, this is not a strategy I would recommend when investing for beginners.

Long story short, you need to decide what investment product you want, find the code (either the ticker or ISIN), and then search for it through your broker and buy it. Simple enough, right?

ETFs

How do I invest in indexes, such as S&P500?

We know from previously in our investing for beginners guide that indexes track a specific feature of the market: they may track the performance of all stocks, of tech stocks, of government bonds, or more. As they are a basket of different financial products, they already offer some diversification, and for that they are very appealing for beginners. Trouble is, you cannot invest in an index.

In fact, an index is just a “tracker” of a group of different financial securities. If you want to invest in it, you need to check out all the financial securities that are included in the index and buy each on your own. Not very practical, and quite expensive as well. But wait, there is a better way.

There are investment companies that buy all the securities in an index in bundle and create a financial product that represents the index. You can then buy that product, which is an ETF (Exchange Traded Fund). These ETFs have an ISIN code, which mean you can buy them with your bank or broker. In addition to those, online brokers often create products that are similar to ETFs on their own as well.

The biggest producer of ETFs are:

By going to their websites, you can quickly search for a list of ETFs they offer. They offer you the most classical index-mirrored investments, such as S&P500 or MSCI ACWI, as well as other different and more advanced products.

Execute the Ultimate Investing for Beginners Strategy

What investment should I buy?

Wonderful, you made it so far in this investing for beginners guide: you are ready to invest. As always, you are the one that should know what investment and level of risk if better for you, so do not follow what you see here blindly.

When investing for beginners, investing in the MSCI ACWI index is a good approach. This index mirrors the overall economy of the world by buying securities from both developed and developing countries. It has an average yearly return just south of 10% over a long time horizon. Once you buy this security, expect to hold it for years – decades potentially. If you want a shorter time horizon for your investment, then beginners stuff is probably not the thing for you.

I have personally invested in this strategy, in particular with the ETF made by iShares: iShares MSCI ACWI UCITS ETF. If you are in Europe, the ISIN code for this product is IE00B6R52259.

Another good option if you are based in the US is the S&P500, as it reflects the US economy. However, considering a geography wider than the US will allow you to diversify even better.

Potentially, one investment of this kind is enough.

Beware of Implicit Risks

Is there something else I should consider?

You bet. Investing for beginners is not devoid of risk. While most of the risk may seem clear and embedded in your investment, there are others risk you want to consider.

The first and most important is currency risk, or forex risk. If a financial product trades in a currency that is not your own, you need to consider exchange rates between your currency and the one of the product. Say you are based in Europe and have EUR, and you want to buy an US stock that trades in USD. This is not a problem when you buy it, but it might be when you sell it. When you sell it, in fact, you will get USD, and how many EUR you can get from each USD will depend on the exchange rate. So, the performance of your investment is also influenced by currencies. If your investment has small returns, currency can potentially wipe them out.

Fortunately, most popular financial securities are created in many different currencies to ease trading. Nonetheless, some risk still exists as these securities simply embed the foreign currency conversion in their price.

Another common risk is the liquidity risk. When you decide to sell your investment, will there be anyone to buy it? This influences how liquid your investment is, that is how quickly and easily it can be converted into cash. Most ETFs and stocks have enough liquidity, however you may consider the size of your investment. For example, in an ETF you are looking for total funds under management of at least one billion dollars. This means there is enough trading and people investing in this product.

Finally, there is the counterparty risk, the risk that the provider of the fund, or the company, will default. This tends to be a more realistic risk when investing in companies, because even if a fund was to fail it was only buying other financial products and reselling them, so they still belong to customers.

Don’t Panic

Are there some extra tips I should follow as a beginner?

Yes, we will conclude this investing for beginners guide with some nice tips. Those are nothing revolutionary, just common sense.

The first investing for beginners tip is to be comfortable with your investment, investing only in the products you are comfortable with, and with the amount you are comfortable with. This may mean invest a lot for some people, or very little for some others.

Once you have an investment you are comfortable about, never panic. Realize it will fluctuate, go up and down, and there might be periods that is significantly down. The worst thing you could do is buy high in the midst of the hype and sell low in the midst of the panic. This is a guaranteed strategy to lose money.

If you are investing for a long time horizon – which you should as a beginner – don’t be obsessed checking the status of your portfolio every day. Once a month can be enough. If you have seen some comedy movies, there’s always a kid being driven somewhere who asks “Have we arrived? What about now? And now? Are we at the destination?” – don’t be that kid with your investment.

Conclusion

With this investing for beginners guide we aimed at giving you all the tools you need to start investing. Investing is a crucial part of managing one own’s finance, and anyone should do it. In fact, it is probably the best way to preserve and expand your wealth over the long term.

I hope this guide will get you started – if you made it this far and you want to stay in touch and tell me how it goes I’ll be glad to connect on LinkedIn, just reach out to me and write in your message that you read this guide.

Suggested Readings

You should never settle with what you know because you can always know more. So, let me suggest some good reading that can take you to quite a good level in terms of investing.

- The Ultimate NPV Guide

- Finance: The Basics by Erik Banks

- Corporate Finance by Jonathan Berk, Peter DeMarzo

You should read these in that order, they will help you understand better the financial world. It will take some time, but you will have quite powerful tools under your belt. Definitely recommended.

Sources

Below, the sources mentioned in the guide.

- Why buying a house today is so much harder than in 1950

- Standard Deviation

- How Ray Dalio helped launch McDonalds Chicken McNuggets

- Venture Capital illiquidity

- The Efficient frontier and the Tangent Portfolio

- CAPM

- MarketWatch small-cap outperformed Total Market Index

- Milton Friedman Book

- Berk, DeMarzo – Corporate Finance ISBN 978-1292160160