Project managers need to know how to select a project. In fact, any manager should know how to select a project. While having ideas is good, resources are always limited so you need to know which idea to pursue, and which one is simply not good enough. In this guide, we give you some insight on the method large corporations use to select projects.

How to Select a Project?

The Intuition

The idea that drives us to select a project is simple: we want to do the best project first. Each project, in fact, carry some outcomes. Those outcomes may be simply the creation of a document which we can use to make better decisions (i.e., a research project), creating a new product, launching a new product line, and more.

Each project will bring some benefits as part of its outcome, and it will also have a cost. So, deciding which project to pursue is a tradeoff between costs and benefits of the project. First, we need to identify the “net benefit” of each project, benefits less costs. Then, we can compare the “net benefit” of all projects and pick the one with the highest net benefit.

This intuition is remarkably simple, but the execution it is not so straightforward. Often, it is hard to measure benefits in an objective, let alone compare projects of different nature. For example, how do you compare e research project with launching a new product line, or revamping your truck fleet?

Even comparing costs is not an easy feat. It is subtle, because it seems easy at first – you just need to estimate how much money you will spend, but it is not. You also need to consider other costs, such as the time of people working on the project, which people are working on it and how many of them, even the space they occupy in the building to do the project (important in case of manufacturing when large spaces are at stake, less important for office work). How do you make sense of all of this? Welcome the NPV method.

NPV method

NPV is the acronym of Net Present Value, and it is the “net benefit” that the project brings to the table. It is expressed in today’s money, for example today’s dollars. We say today, because the value of money change over time: one dollar today in your hand is not the same as one dollar you will receive 1 year for now. More on this later.

Costs and benefits are not homogeneous, as we saw. So, if we want to know how to select a project, we first need to convert all costs and benefits to a common unit, a way of comparing them. This is where the concept of Present Value comes in. Put it simply, present value is the economic value of any event, expressed in today’s dollars.

Calculating the present value of something is a two-steps process.

- We need to convert a non-economic event into economic terms

- Then, we need to transform the economic value we obtained in today’s dollars

Now that you have the intuition right, we can dive deeper into these tasks to finally find how to select a project, in the best possible way (at least from a financial point of view).

How to Select a Project using 5 NPV Steps

1. Estimate Non-Economic Events

Some projects will naturally provide some economic outcomes. You may increase your marketing expense to increase your sales, and thus your profits, and you can quite well calculate the expected economic value of it. However, most projects have at least some non-economic costs or benefits. You need to account for those if you want to know how to select a project properly.

So, start by laying out all the consequences of your project, starting from first-order consequences. These are the consequences that happens directly as a result of you taking on the project. Then, start from these to identify indirect consequences: first second-order consequences, and then third-order consequences. To put it simply, you should repeatedly ask “and then what?” until you are satisfied.

For example, imagine we want to run a television ad to publicize our new line of ice creams. One of the direct consequences is that some people will see the ad. Then, some will remember the brand, and some of them will buy it in store. Based on these consequences, we can start to make assumptions about what will happen exactly in each stage, for example supposing that only 1% of people who see the ad will end up buying our ice cream in the next month or so.

Of course, the more data you already have the better your predictions will be. If you already had run TV ads in the past, you may have collected their impact on sales.

If 10 million people see your ad, and 1% of them buy your product, that’s 100k customers. If one product is sold at $5, then this is a $500k sales. If your average profit is about 20%, then your profit will be $100k, if running your ad costs less than that then it seems to make financial sense.

You can pretty much transform any event into the effects it will have on your financial performance to estimate its economic value. Of course, having an estimate is risky. It is better to do three estimates, the worst case, best case, and most likely case.

2. Identify the timing

From the first step of how to select a project a project, we converted all non-economic events to economic terms. Now, we have a project where each outcome and cost is expressed in financial terms. That is not enough.

In fact, to properly select a project, we need to know the timing of these events. When will you receive cash? When will you incur in costs? As a general rule, the closer they are to the present the more they will impact the project.

Try to be as precise as you can, for example “I expect these sales to be realized in two quarters from now”. Try to associate each event to a time period you are using to benchmark your performance. If you are benchmarking on month, identify the month during which an event will happen. If you are using quarters, use quarters, and so on.

An event doesn’t have to be a point event. You can spread it across multiple periods. For example, if you are measuring month-by-month but extra sales will happen over the course of a quarter, you can put 33% of sales into each month of that given quarter, assuming an even distribution.

3. Calculate Present Value

At this point we have a list of economic terms happening at different point in time. It is no secret that this guide on how to select a project relies on present value, and that’s what we will do now.

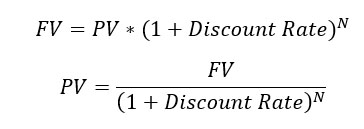

To calculate present value, you need to know the economic value in future value terms – that is, the amount of money you will receive at the time when you actually receive it – the discount rate, and the periods involved.

Periods are simple, it indicates how many units of time the date is far away from now. If you are measuring on months and the date is next year, you will have 12 periods. The same date but measured in years will be only 1 period away, in quarters 4 periods away. You get the point.

Now, the discount rate is how much your money can make to you if you invest it over one period. If money in the bank can yield 1% over a year, and your period is 1 year, then your discount rate is 0.01 (1%). Note that here we do not mean any investment, we mean an investment with a risk that is comparable with the risk of the project. More on this later.

Provided this information, this is the formula of Present Value.

Now, your job is to simply calculate the present value of all cash flows, that is, of all timed economic-value-converted events.

4. Calculate NPV

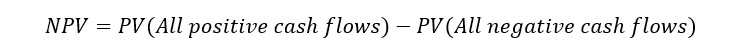

How to select a project? You need NPV. Net Present Value is simply the present value of benefits net the present value of costs. You can quickly see the formula below.

This is a simple subtraction and addition, which result in the absolute value of your project. If you have multiple projects, rank them by NPV and take the one with the highest NPV first, and then move down as long as you have money and resources to invest. Do the highest NPV projects first. Do not trust any other rule, this is the only one that will make you better off.

5. Deciding the Discount Rate

How to select a project without knowing the discount rate? You cannot! Discount rate is crucial in defining the value of a project, and hence deciding if and how to select a project. You really need the discount rate.

So, to find it, you have to do some research. You need to find an industry that closely resembles the scope of your project (soft drinks? Airlines? Biotechnology?) and find the discount rate used in that industry. If you need to start, you can apply this table.

Of course, these are not just made-up numbers. There are important corporate finance rules behind them, but for the purpose of knowing how to select a project, just having the table will be good enough.

Go Deeper

This guide on how to select a project based on its NPV value is a quick cheat, something that will bring you straight the result saving you a lot of the messy details and beautiful math that runs behind.

Yet, if you are involved in the decision-making process of a company and you have decide how to select a project, it may be well worth it to understand it all. We have a longer guide that explains in detail everything you need to know. It is the Ultimate Guide to NPV, and it will address not only the “how”, but also the “why”. If you are a project manager, that guide is a required stop.